Seven-in-One

Multi-module, Zoyan-first ecosystem; each module works alone and feeds others via shared data loops.

Residual Risk ≈ 10–15%

Concentrated in adoption, local execution, and macro. Core marketplace risks handled by design.

AI Accelerator

System works without modern AI; AI adds uplift (personalization, seller copilot, fraud, creative automation).

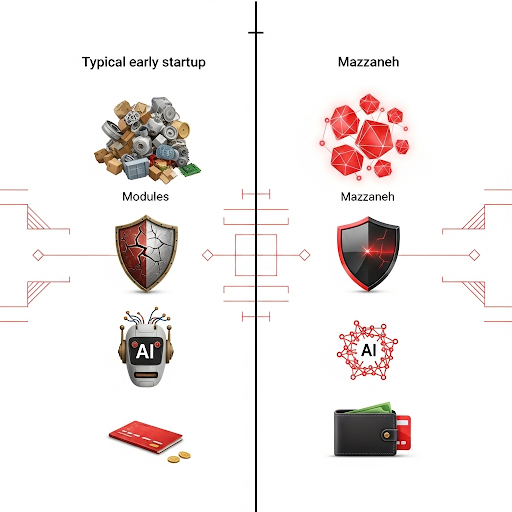

Why a “fair comparison” needs a non-standard lens

Typical Seed/Series-A ventures are single-core apps; Mazzaneh is an interlocked ecosystem. Copying one module in isolation cannot reproduce outcomes.

| Dimension | Typical early startup | Mazzaneh |

|---|---|---|

| Product scope | Single core | 7 interlocked modules |

| Defensibility | Feature-level | Architecture/data interlocks |

| Trust & Safety | Added later | Baked-in (blue tick, optional escrow, disputes) |

| User economics | Fees on users | Create user income + 20% on withdrawal |

| AI role | Add-on | AI-ready from day one (Zoyan-first) |

| Field proof | Low-friction markets | Stress-tested in Shiraz |

Investor FAQ — Risks & Definitive Answers

1) How is trust & safety ensured with in-store/cash transactions and no platform commission?

Baked-in controls: blue-tick seller verification, transparent store policies (returns, shipping, fees), public ratings, and dispute follow-through. Optional ~1% escrow holds funds until the buyer confirms receipt and satisfaction.

Blue-tickEscrow ~1%Dispute SLA2) Why does Radar return “stores only” by default?

To minimize risk in local meetups and ensure quality. Buyers can inspect the item in person and receive cashback. Individuals are not surfaced by default results.

Local StoresIn-Store + Cashback3) How does Pulino prevent abuse?

Wallet gating at 2,000 MZN, daily caps (3 follows + 1 Board), KYC on withdrawal, mandatory purchase within 3–4 months for each declared trait, refunds to advertisers when data is misdeclared, and account/IP blocking.

Wallet GatingKYCRefunds4) If one module goes down, does monetization stop?

No. Each module has pre-fed data and parallel paths, allowing it to operate independently for months while others recover. Interlocks share outcomes across modules.

Data InterlocksFallback Paths5) Why so many modules? Isn’t that complexity risky?

The endgame is Zoyan—an executive assistant that executes the end-to-end commerce/advertising loop on command. Modules must exist and connect for Zoyan to act. Each module solves a distinct user pain (income vs. productivity), maximizing adoption while making single-module copying ineffective.

Zoyan-firstMulti-PersonaDefensibility6) How is a no-commission model sustainable?

Revenue from Board/Follow budgets, paid leads/visits, pro/admin accounts, banners, analytics/data subscriptions, and, crucially, the 20% withdrawal commission in Pulino. Incentives align with both users and businesses.

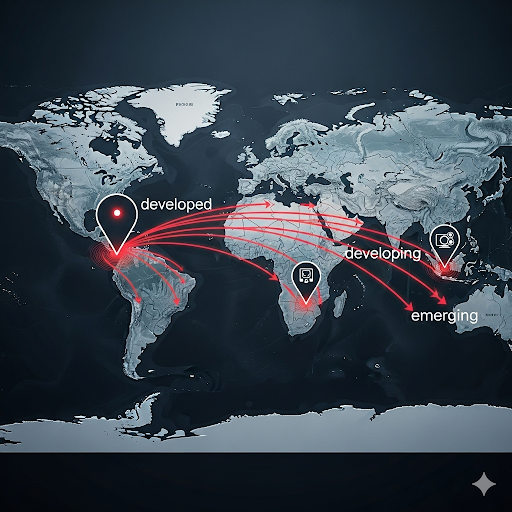

Pay-per-Lead/Visit20% WithdrawalPro Accounts7) International adoption & local execution risks?

Multi-country pilots, persona-specific messaging (Zoyan for productivity seekers; income/cashback for price-sensitive cohorts), partner-first (payments/logistics), repeatable playbooks, and local advisory boards.

Multi-Country PilotPartner-FirstLocal Advisors8) Macro/regulatory shocks?

Geographic diversification, favorable legal entities, FX hedging, and an operational Plan-B for rapid suspension/exit if needed.

DiversificationLegal/FX HedgePlan-B9) Returns/shipping policies & restricted goods?

Stores declare policies at onboarding; users see them when deciding. Blue-tick relies on policies, history, and ratings. Restricted goods and logistics partnerships are set per country with reputable partners; some anti-counterfeit tactics remain undisclosed to prevent gaming.

Transparent PoliciesCountry Compliance10) Why keep GTM playbooks private?

They are innovative, adjustable, and represent competitive advantage. Shared privately in diligence; core principles remain: multidimensional segmentation, scenario-based acquisition, partner-first, orchestrated by Zoyan.

Confidential PlaybooksScenario-Based GTMResidual Risk Map (≈10–15%)

Adoption

Pilots across developed/developing/emerging markets; localized messaging; co-creation groups; prove module value rapidly.

Execution

Partner-first in payments/logistics; repeatable playbooks; local advisors; transparent module-level dashboards.

Macro

Geographic diversification; secure legal structures; FX hedging; contingency plans.

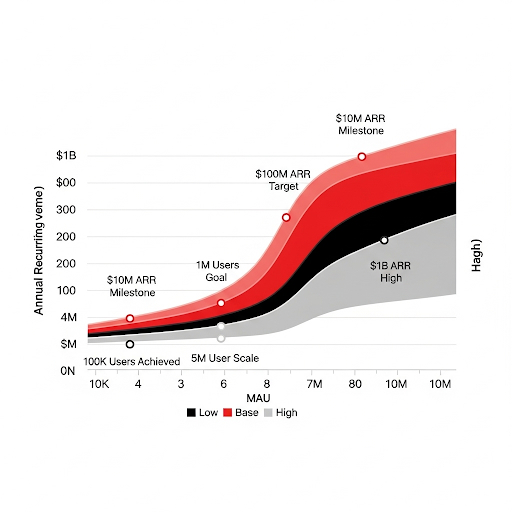

Scenario Valuation

36–48 months (international):

MAU: 3–5M | ARPU: $20–$40/yr → Revenue: $60–$200M/yr

Peer revenue multiples (ad-tech/commerce enablement): 4–8× sales

Implied Enterprise Value:

Low: $180–240M • Base: $600–800M • High: $1.2–1.6B

Fair Value Today (pre-international revenue): $100–150M given architecture maturity & embedded risk controls; country pilots remain to be proven.

Value Inflections:

Pilot #1 (MAU ≥100k; ≥5 repeat advertisers): $180–300M

Early scale (MAU ≥1M & ARR ≥$30M): $300–500M

Scale (MAU 3–5M & ARR $60–200M): $600M–$1.6B