Creative, Challenge-Driven Reporting

Young product, MVP in Shiraz, several first-of-their-kind modules. We publish scenario ranges with explicit assumptions, invite public stress-tests, and run a $1,000 prize to beat Mazzaneh Radar.

Future Vision

We orchestrate modules into a defensible system, not a pile of features. Copying a button won’t replicate our economics.

Scenario Forecasts

Pessimistic / Base / Aggressive scenarios, with assumptions you can recalc. Updated monthly with GA signals.

$1,000 Radar Challenge

Demonstrate a simpler, faster, more beneficial local-buying solution than Radar—win the prize.

We Bring Business Ideas to Life

We chose a limited, low-noise MVP in Shiraz to learn fast, fix fast, and tune module connections before any nationwide launch.

Because there is no national launch yet, national-scale metrics would be misleading. We anchor public web reporting to the current GA property (Jan–Today 2025), and report Android installs separately (approx. 40k, may be more/less).

Due to macro conditions, we accelerated an international launch path. Some data-first modules will be fully operational only after their data thresholds are met.

Methodology Over Marketing

We define success metrics per problem solved; publish ranges not single numbers; and keep a transparent calibration trail.

Data-First Gate Tests

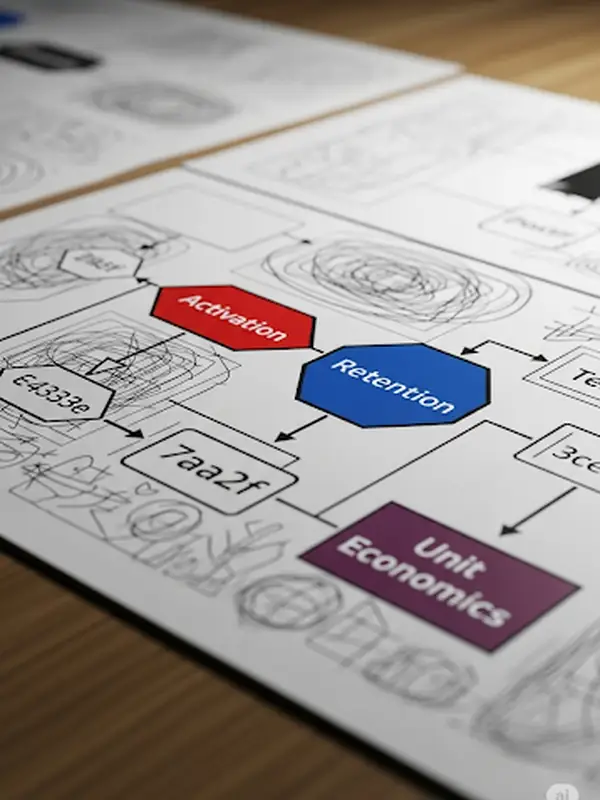

Activation → Repeat/Retention → Unit Economics. Modules operationalize only after hitting their data thresholds.

Why You Choose Us

No paywall for ordinary users. Costs are on businesses; user adoption powers the flywheel.

Multi-source revenue portfolio. If one stream dips, others compensate—no single-point dependency.

Privacy-by-design. Consent-based data, KYC for payouts, and anti-abuse layers.

Systemic defensibility. The value comes from orchestration (Radar+Begir+Board+Pulino+Zoyan), not a single UI control.

A Connected System > A Pile of Features

Radar (local demand fulfillment) works with Begir (private RFQ), Board (consent-based ads), Pulino (user income), and Zoyan (operator assistant). We lock Radar in a city until supply thresholds are met, then the flywheel lights up: demand → reply → chat/visit → offline purchase/referral → consented behavior data → optimization → resilient revenue.

Facts and Numbers (Web • GA Jan–Today 2025)

≈ 94k

Active Users

≈ 112k

New Users

≈ 308k

Views

≈ 870k

Events

Android installs: ≈ 40k (approximate; reported separately for measurement hygiene).

Seller CPC/Session

Qualified views/chats/referrals to seller sites.

Board (CPC/CPA)

Consent-based targeting; lower budget waste, better ROAS.

Pulino (User Income)

Payout/revenue-share with KYC + anti-abuse.

B2B Analytics

Demand insights and operational dashboards.

Zoyan (Later)

Premium assistant subscription in advanced phase.

Account Top-Up

Live now for businesses with sites; strong acceptance.

Design logic: not dependent on one or two streams—each covers others. If one underperforms, the portfolio compensates. User adoption is the engine: more users → more supply → more interactions → platform + user revenue (Board/Pulino/…) + consented data → optimization and better ROAS → stronger word-of-mouth.

- Policies: No paywall for ordinary users. Business-paid, transparent value. Privacy-by-design.

- Funnel KPIs: RFQ → quote → offline purchase/referral (conversion, time-to-first-quote, seller SLA).

- Supply KPIs: leads → onboarding → activation → retention (ARPA, session-to-chat).

- Loyalty: cohort retention (D7/D30), depth of interaction (RFQ/Board/Pulino/Zoyan).

How We Report Under Low Data

Performance track (What/How): what we built and why; gate tests (Activation → Repeat/Retention → Unit Economics); data thresholds that trigger operational rollout.

Scenario track (Forecasting): conservative/base/aggressive scenarios with explicit assumptions (activation, seller participation, CPM/CPA, payout frequency, ARPU, SLA). We update monthly with new GA signals and keep a visible calibration history.

Judge Our Forecasts Without Historical Revenue — Stress-Test These

Don’t trust claims—stress-test the mechanism with only public info on our site.

Radar (Local Fulfillment)

- Is there any software worldwide that makes local buying/selling simpler, faster, and more beneficial than Mazzaneh Radar?

- Does it beat Radar on TTT, conversion, seller SLA/coverage (without higher overhead), and cost-to-serve—in practice?

Board (Advertising)

- What channel identifies and shows ads to true targets more precisely—with ≈ <5% budget waste?

- To reach the same feature awareness among real targets, what alternative stack and cost would be required elsewhere?

- Real target followers, persistent surface (posts/proofs over 6 months), geo/gender/job/interests/count/age filters, from millions down to a small remote shop?

- Broadcast important social messages to specific cohorts with the same control?

Pulino (User Earning)

- Which platform offers more earning options—especially from opportunities others never tapped?

- With upcoming additions that multiply income by interests/traits, is there a more personalized earning ecosystem?

My Closet & Taste Profiling

- Who solves fit/style uncertainty and the daily “what do I wear?” while transforming sell-through for fashion better than this approach?

Deep Analysis (For Businesses)

- Where else do you see consent-based, user-centric data stitched from day one to deliver operational insight of this depth?

Zoyan (Operator Assistant)

- Which assistant actually does work (follow-ups, first-line replies, reminders, prioritization, reporting) and for users handles ordering, My Closet, Radar coordination—then self-personalizes deeply over time?

- Have you seen marketing/acquisition rely this much on an operator assistant whose capability instantly expands as the platform grows?

$1,000 Mazzaneh Radar Challenge

If you can demonstrate a practical solution that is simpler, faster, and more beneficial than Radar for buyers, sellers, and society, we’ll pay $1,000.

Evaluation Criteria

- Time to Transaction (TTT)

- Conversion (request → quote → purchase)

- Seller SLA & geo/hour coverage (without costly overhead)

- Cost-to-Serve for local sellers

- Consent/Privacy & anti-abuse posture

- Portability across cities without brittle dependencies

FAQ: “Why trust your forecasts without historical revenue?”

Short answer: Don’t trust claims—stress-test mechanisms.

- We publish assumptions and show scenario ranges.

- We recalibrate monthly with GA-based signals.

- We invite public stress-tests of Radar, Board, Pulino, My Closet, Deep Analysis, and Zoyan.

- We run a $1,000 challenge on Radar.

- Need depth? We can proceed with a Data Room under NDA.